Understanding Tractor Depreciation: A Farmer's Guide to Tax Savings

Farming is hard work, and understanding tax regulations shouldn't add to the burden. This guide simplifies tractor depreciation, a crucial aspect of farm tax planning, helping you maximize deductions and reinvest in your farm's future. We'll break down complex concepts into clear, actionable steps, empowering you to make informed financial decisions. Remember, while this guide offers valuable information, consulting a tax professional for personalized advice is always recommended. For a fascinating look at how tractors evolved, check out this tractor history.

Depreciation Basics: Understanding MACRS

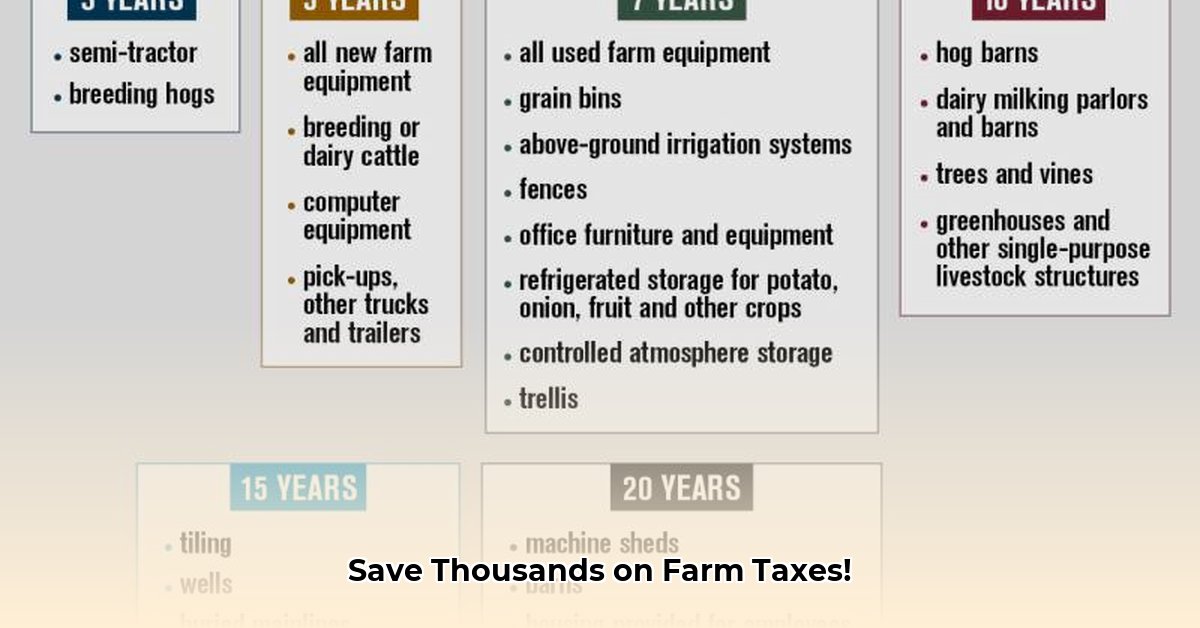

The IRS uses the Modified Accelerated Cost Recovery System (MACRS) to determine how quickly you can deduct the cost of your farm equipment, including tractors. Tractors typically fall into the 5-year property category, meaning you can write off their cost over five years. This helps reduce your tax liability over time. Think of it as spreading out the cost of your tractor across its useful life, making it easier to manage financially. How much you can deduct each year depends on the chosen depreciation method.

Choosing Your Depreciation Method: Straight-Line vs. Accelerated

Two primary methods exist for calculating depreciation:

Straight-Line Depreciation: This method deducts an equal amount each year. It's simple to calculate and provides predictable tax savings. However, it offers slower initial tax savings compared to the accelerated method.

Accelerated Depreciation: This method, such as the double-declining balance method, allows for larger deductions in the early years of your tractor's life. This results in significant upfront tax savings, beneficial for cash flow management. However, deductions are smaller later on, and the calculations can be slightly more complex.

Which method is right for you? The optimal choice depends on your unique financial situation and long-term goals. Need a cash boost now? Accelerated might be preferable. Prefer consistent savings over time? Straight-line could be a better fit. A visual comparison of both methods, highlighting the differences in annual deductions, would greatly benefit the decision-making process. [Data from draft article would be inserted here in a table format]

Section 179 Deduction: A Significant Tax Break

Don't overlook the Section 179 deduction! This powerful tool allows you to deduct the entire purchase price of qualifying equipment in the year you buy it, up to a specified limit (check the current IRS limits). This can significantly reduce your tax bill immediately, freeing up capital for farm improvements or expansion. Is your new tractor eligible for Section 179? It's worth investigating!

Integrating Depreciation with Sustainable Farm Practices

Smart tax planning isn't just about saving money; it's about investing in your farm's future. By optimizing tractor depreciation, you can free up resources for sustainable practices like improving irrigation, adopting renewable energy, or implementing soil conservation techniques. These investments enhance your farm's long-term productivity and resilience, benefiting both your bottom line and the environment. It's a win-win scenario.

Expert Guidance: Seek Professional Tax Advice

Navigating tax regulations can be complex. Consulting a tax professional ensures you make the most informed decisions, maximizing deductions while adhering to all regulations. They can analyze your specific situation, advise on the best depreciation method, and help you utilize Section 179 effectively. This is an investment that protects your farm's financial health.

Long-Term Planning: Adapting to Change

Remember, effective tax planning evolves alongside your farm. Regularly review your depreciation strategy, accounting for changes in tax laws, your farm's financial performance, and future investment plans. Proactive tax management safeguards your farm's financial strength and growth potential.

The Future of Tractor Depreciation: Adapting to Technological Advancements

Agricultural technology is rapidly evolving, leading to potentially shorter lifespans for some advanced farming equipment. This might influence how we calculate depreciation in the future. Staying informed and adapting your approach to tax planning is crucial to always maximize your benefits.

Actionable Steps: Maximizing Your Tax Benefits

Here's a step-by-step guide to maximizing your tractor depreciation deductions:

- Determine your tractor's cost basis: This is the original purchase price plus any additional costs associated with acquiring and putting it into service.

- Choose your depreciation method: Carefully weigh the pros and cons of straight-line versus accelerated depreciation, considering your specific financial goals.

- Calculate your annual depreciation: Use the appropriate formula (straight-line or accelerated) to determine the amount you can deduct annually.

- Consider the Section 179 deduction: Determine if your tractor purchase qualifies for this immediate deduction.

- Maintain complete records: Keep detailed records of all purchases, expenses, and depreciation calculations. This ensures compliance with IRS regulations.

- Consult a tax professional: They can provide personalized advice based on your unique situation and ensure you're adhering to all relevant tax laws.

This step-by-step process, combined with the insights provided in this guide, will empower you to successfully navigate the complexities of tractor depreciation and make sound financial decisions for your farm. Remember, proactive tax planning is an investment in your farm's long-term success and sustainability.